Legacy Giving: Ensuring Lifelong Care

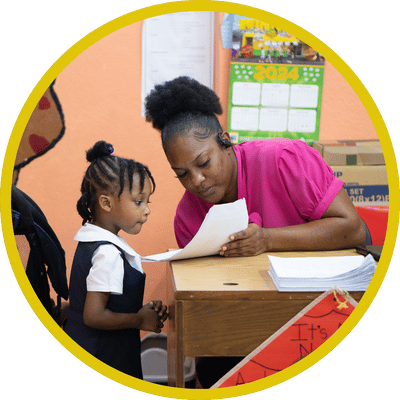

Noella’s Story

Noella’s life is a living legacy of love and commitment. Abandoned as a child because of her disabilities, she found her forever home at Mustard Seed Communities—where she continues to receive daily care, therapy, and the embrace of family decades later.

Her story reminds us that the promise of lifelong care doesn’t happen by chance—it’s sustained by the generosity and foresight of people who include Mustard Seed in their legacy plans. Because of gifts made years ago, Noella’s laughter still fills her home today—and tomorrow, others will experience the same unwavering love.

Have you included Mustard Seed Communities in your

Let us know so we can thank you and welcome you into Vine and Branches, our Legacy Society.

Leave a Legacy of Love

Your faith, compassion, and generosity can live on through a legacy gift to Mustard Seed Communities. By including MSC in your estate plans, you ensure that children and adults with disabilities, children affected by HIV, and young mothers in crisis will be cared for with dignity and love for generations to come.

Legacy giving is more than a financial decision—it’s a reflection of your values and a way to extend your impact far into the future. No matter the size, your gift will help Mustard Seed Communities remain a place of hope and family for the most vulnerable of God’s children.

Why Legacy Giving Matters

Your gift will help Mustard Seed Communities provide:

Homes and lifelong, loving care for individuals with disabilities

Nutritional, medical, and educational support for vulnerable children

Sustainable community programs that create brighter futures

By planning ahead, you not only bless future generations—we can also recognize and honor your generosity today through the Vine & Branches Legacy Society, our community of forward-thinking supporters committed to Mustard Seed’s mission.

Ways to Make a Planned Gift

Bequests

One of the simplest and most popular legacy gifts, a bequest is made through your will or trust. You can designate a specific amount, a percentage of your estate, or the remainder after other obligations are met. This gift costs you nothing during your lifetime but makes a lasting difference for future generations.

Retirement Plans & Life Insurance

By naming Mustard Seed Communities as a beneficiary of your retirement account (IRA, 401k, etc.) or life insurance policy, you can support MSC’s mission while potentially reducing taxes for your heirs.

IRA Charitable Rollover

If you are 70½ or older, you can give directly from your IRA to Mustard Seed Communities. These gifts, called Qualified Charitable Distributions (QCDs), can satisfy your Required Minimum Distribution (RMD) and reduce your taxable income, while supporting MSC today.

Donor Advised Funds

Donor Advised Funds (DAFs) are an increasingly popular way to make charitable gifts. You can recommend grants to MSC from your fund at any time and, if you wish, designate Mustard Seed Communities as a beneficiary of your DAF to continue your giving legacy.

Real Estate & Appreciated Assets

Donating real estate, stocks, or other appreciated assets can provide you with significant tax benefits while directly supporting our work around the world.

Your Legacy, Your Impact

No matter the size, every planned gift makes a difference. By including Mustard Seed Communities in your estate plans, you join a compassionate community of supporters whose faith and generosity will continue to change lives long into the future.

If you have already included MSC in your plans, please let us know—we would love to welcome you into the Vine & Branches Legacy Society and ensure your gift will be used according to your wishes. Information you share will be kept confidential and we respect any desire to remain anonymous.For more information or to discuss your legacy gift, please contact us at legacy@mustardseed.com or call 508-213-8490.

Legal Documentation

Please reference Mustard Seed Communities’ federal tax identification number, legal name, and address when drafting documentation.

Federal tax identification number: 58-1657207

Legal Name: Mustard Seed Communities, Inc.

Address: Mustard Seed Communities

200 Reservoir St.

Suite 306

Needham, MA 02494

Sample Last Will & Testament Language

When including Mustard Seed Communities in your Last Will and Testament, you are welcome to use the following sample language:

“I give to Mustard Seed Communities, Inc., located in Needham, Massachusetts, with Federal Tax Identification Number of 58-1657207,

the amount of $_____ to be used for its general purposes.”

“I give to Mustard Seed Communities, Inc., located in Needham, Massachusetts, with Federal Tax Identification Number of 58-1657207,

_____ % of the residuary to be used for its general purposes.”